How to Improve Programming Logic with These Programs

Read More

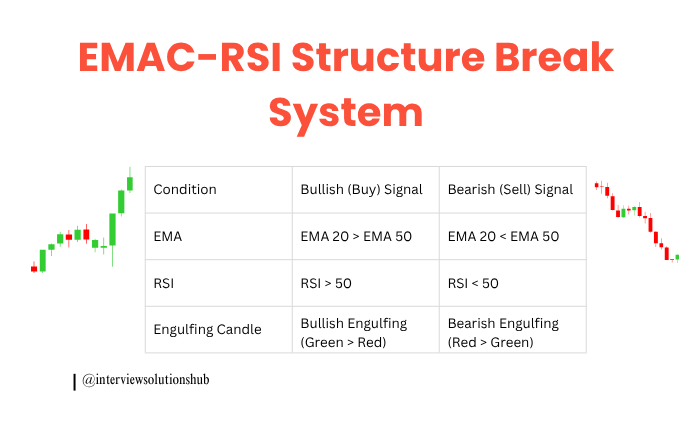

Creating a high-accuracy trading strategy requires a mix of proven technical indicators, strong risk management, and a well-tested ruleset. Below is a professional-level, high-accuracy trading strategy that works best for crypto or forex in 15 min to 1 H timeframes—but it can be adapted.

Goal: High-accuracy trend-following + structure-based trading

Win Rate Potential: 70–80% (with discipline)

Best for: Crypto Futures / Forex / Indices

Timeframes: 15M / 1H / 4H

Indicators Used:

EMA 20 + EMA 50

RSI (14)

Market Structure (BOS, CHoCH)

Price Action Candles (Engulfing, Pin Bars)

(Optional: ATR for SL sizing)

Trend Confirmation:

EMA 20 is below EMA 50

Price is below both EMAs

Structure Break:

Look for Break of Structure (BOS) or Change of Character (CHOCH) to downside

Confirm with bearish engulfing or pin bar candle

RSI Filter:

RSI crosses below 50 or is between 40–30 (not oversold)

Entry:

Enter on candle close after break or retest of broken support/structure

Optional: Use FVG zone or order block for precise entry

Stop Loss:

Just above the last swing high or structure (~ATR × 1.5)

Take Profit:

TP1 = 1:1 (move SL to breakeven)

TP2 = 1:2 or next key support level

Trend Confirmation:

EMA 20 is above EMA 50

Price is above both EMAs

Structure Break:

Look for BOS or CHoCH to the upside

Confirm with bullish engulfing or hammer candle

RSI Filter:

RSI crosses above 50 or is between 60–70 (not overbought)

Entry:

Enter on candle close after break/retest

Refine using FVG, OB, or key level

Stop Loss:

Just below last swing low

Take Profit:

TP1 = 1:1

TP2 = 1:2 or next resistance

Risk only 1–2% per trade

Always use stop loss

Trade only clean setups — skip choppy price action

Max 2–3 trades per session

EMA 20 < EMA 50 ✅

BOS formed ✅

Bearish engulfing candle ✅

RSI = 42 ✅

Enter after candle close

SL = 15 pips, TP1 = 15 pips, TP2 = 30 pips

Add Fair Value Gap (FVG) zones as confluence

Use Trendlines to trap breakout

Integrate MACD divergence as secondary signal

Use Volume for confirmation (low-volume pullback = strong)

RSI is overbought (for long) or oversold (for short)

EMAs are flat (no trend)

Price is ranging or choppy

During high-impact news (use Forex Factory / TradingView calendar)

Backtest this strategy on at least 100 trades across different pairs

Record your:

Win Rate

R:R ratio

Drawdown

Best performing pairs & timeframes

Here's a complete TradingView Strategy Script (Pine Script v5) that implements the EMAC-RSI Structure Break Strategy for backtesting and live signal generation.

//@version=5

strategy("EMAC-RSI Structure Break", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === INPUTS ===

emaFastLen = input.int(20, title="EMA Fast (20)")

emaSlowLen = input.int(50, title="EMA Slow (50)")

rsiLen = input.int(14, title="RSI Length")

rsiOB = input.int(70, title="RSI Overbought")

rsiOS = input.int(30, title="RSI Oversold")

rsiMid = input.int(50, title="RSI Midline")

sl_pct = input.float(1.0, title="Stop Loss (%)", minval=0.1) * 0.01

tp_pct = input.float(2.0, title="Take Profit (%)", minval=0.1) * 0.01

// === INDICATORS ===

emaFast = ta.ema(close, emaFastLen)

emaSlow = ta.ema(close, emaSlowLen)

rsi = ta.rsi(close, rsiLen)

// === STRUCTURE CANDLE CHECK ===

bullEngulf = close > open and close > close[1] and open < open[1]

bearEngulf = close < open and close < close[1] and open > open[1]

// === CONDITIONS ===

// Long

longCond = emaFast > emaSlow and close > emaFast and rsi > rsiMid and bullEngulf

// Short

shortCond = emaFast < emaSlow and close < emaFast and rsi < rsiMid and bearEngulf

// === ENTRY ===

if (longCond)

strategy.entry("Long", strategy.long)

strategy.exit("TP/SL Long", from_entry="Long", stop=close * (1 - sl_pct), limit=close * (1 + tp_pct))

if (shortCond)

strategy.entry("Short", strategy.short)

strategy.exit("TP/SL Short", from_entry="Short", stop=close * (1 + sl_pct), limit=close * (1 - tp_pct))

// === PLOTS ===

plot(emaFast, title="EMA 20", color=color.orange)

plot(emaSlow, title="EMA 50", color=color.blue)

hline(rsiMid, "RSI 50", color=color.gray, linestyle=hline.style_dotted)

Recent posts form our Blog

.png)

.png)

.png)

0 Comments

Like 0